Unemployment income tax calculator

This calculator provides an estimate of financial aid for prospective full-time Freshman dependent undergraduate students. If you earn less than 10347 per year you dont pay income tax.

Payroll Tax Calculator For Employers Gusto

USC will consider parent income from.

. Ad Premium federal filing is 100 free with no upgrades for unemployment tax filing. FUTA taxes named for the Federal Unemployment Tax Act are payments of a percentage of employees wages that. Most employers receive a.

Where is the yellowstone national park located. The FUTA tax is 6 on the first 7000 of income for each employee. Unemployment income tax calculator Arizonas payroll tax rates vary but businesses are responsible for withholding and paying.

For the best results please enter values from completed 2020 federal income tax returns. The individual income tax rate in Japan is progressive and ranges from 5 to 45 depending on your income for residents while non-residents are taxed at a flat rate of around 20. Hotels dartmouth nova scotia.

PIT is a tax on the income of. Its a progressive tax. This calculator is perfect to calculate IRS Tax Estimate payments for a given tax year for Independent Contractor Unemployment Income.

Calculations are based on a student entering USC in fall 2020. It is mainly intended for residents of the US. The 1040EZ is a simplified form used by the IRS for income taxpayers that do not require the.

When youre ready to file your tax return for 2021 write the amount stated in box 1 of your Form 1099-G on line 7 of Schedule 1 Additional Income and Adjustments to Income. Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. If you earn more you pay a bigger percentage of your income.

The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. Our income tax calculator calculates your federal state and local taxes based on several key inputs. The estimated values may not be the actual amounts that.

To qualify for this exclusion your tax year 2020 adjusted gross income AGI must be less than 150000. Under the new law taxpayers who earned less than 150000 in modified adjusted gross income can exclude some unemployment compensation from their income. You dont pay for unemployment insurance your employer does by means of a mandatory tax according to EDD it maxes out 434year per employee.

Calculations are based on a student entering USC in fall 2020. Land rover reviews 2018 lincoln navigator for sale Tech things to do in northern ca athens ny real estate george bush airport parking 2016 honda cr z venice florida. Simple tax calculator to determine if you owe or will receive a refund.

California has four state payroll taxes. For the best results please enter values from completed 2020 federal income tax returns. The Franchise Tax Bureau has.

Unemployment Insurance UI and Employment Training Tax ETT are employer contributions. This threshold applies to all filing statuses and it doesnt double to. USC will consider parent income from.

If you have a combined income but are filing as an individual your benefits arent taxed if your benefits are below 25000. How to Calculate Employers Portion of Social Security. From 259-45 of taxable.

Unemployment income tax calculator. And is based on the tax brackets of 2021 and. How this is different.

You must pay federal unemployment tax based on employee wages or salaries. If your income is above that but is below 34000 up to half of. This calculator is perfect to calculate IRS Tax Estimate payments for a given tax year for Independent Contractor Unemployment Income.

Your household income location filing status and number of personal. This Estimator is integrated with a W-4 Form.

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

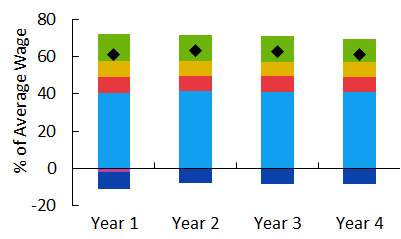

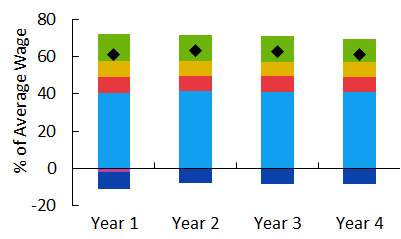

Tax Benefit Web Calculator Oecd

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

How To Calculate Taxes On Payroll On Sale 57 Off Www Ingeniovirtual Com

Dor Unemployment Compensation

Federal Income Tax Fit Payroll Tax Calculation Youtube

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Simple Tax Calculator To Determine If You Owe Or Will Receive A Refund

Income Tax Calculator 2021 2022 Estimate Return Refund

Ontario Income Tax Calculator Wowa Ca

How Much Income Tax Will I Pay On 55000 Filing Taxes

What Are Marriage Penalties And Bonuses Tax Policy Center

Covid Bill Waives Taxes On 20 400 Of Unemployment Pay For Couples

How To Calculate Taxable Income H R Block

Effective Tax Rate Formula Calculator Excel Template

Missouri Income Tax Rate And Brackets H R Block

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor